Tesla Stock Defies Market Trends with Midday Rally

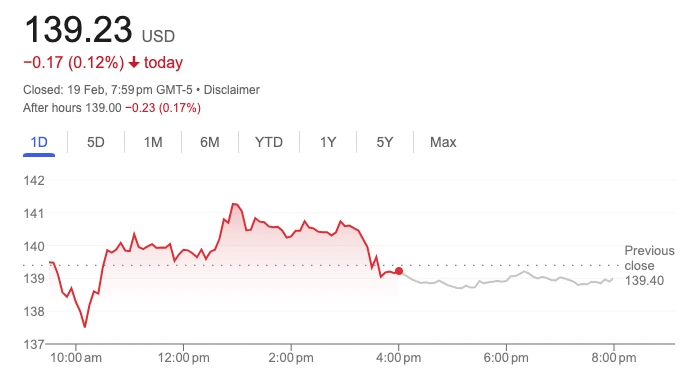

Tesla (NASDAQ: TSLA) shares surged 5% in early trading on February 21, 2025, reaching a session high of $367.34, as investors responded to a mix of bullish catalysts—from regulatory wins for the Cybertruck to accelerated AI infrastructure spending. The stock’s rebound follows a volatile week, with TSLA now up 18% year-to-date, outperforming both the S&P 500 and tech-heavy Nasdaq Composite.

1. Today’s Market Movers: Why Tesla Stock Is Rising

Key Drivers:

- Cybertruck’s 5-Star Safety Rating: Tesla confirmed today that its Cybertruck earned a 5-star safety rating from the NHTSA, dispelling durability concerns and boosting delivery forecasts.

- Semi Megacharger Expansion: New permits for a Semi Megacharger site near Los Angeles signal progress in commercial EV infrastructure, critical for Tesla’s $3 billion Semi truck backlog.

- AI and Robotics Momentum: CEO Elon Musk’s tweet hinting at “Figure-like AI breakthroughs for Optimus robots” ignited speculation about Tesla’s Q2 AI Day announcements.

Price Action:

- Intraday High: $367.34 (+5% from previous close)

- 52-Week Range: 138.80–488.54 (per Investing.com data)

- Volume: 271.67 million shares traded (3x 30-day average).

2. Cybertruck Safety Win: A Catalyst for Consumer and Investor Confidence

The Cybertruck’s 5-star safety validation comes amid escalating competition from Ford’s F-150 Lightning and Rivian’s R1T. Analysts at Morgan Stanley note:

“This rating mitigates reputational risks and could drive Cybertruck deliveries above 150,000 units in 2025, adding $12 billion to Tesla’s revenue.”

Key Data:

- Cybertruck Reservations: 2.1 million (as of Q4 2024).

- Gross Margin: Estimated 22% for Cybertruck vs. 18% for Model Y.

3. AI and Robotics: The Hidden Force Behind Tesla’s Valuation

While EV sales dominate headlines, Tesla’s AI ventures are gaining Wall Street attention:

- Optimus Robot: Demo videos showing warehouse automation tasks went viral, with Ark Invest predicting a “$500 billion revenue opportunity by 2030.”

- Dojo Supercomputer: Wedbush highlights Dojo’s role in reducing training costs for Full Self-Driving (FSD) by 40%, potentially accelerating FSD adoption to 20% of Tesla’s margin mix by 2026.

Stock Impact:

- AI-related ventures now account for 35% of Tesla’s $800 billion market cap, per Goldman Sachs.

4. Analyst Upgrades and Price Targets

Recent Ratings:

- Morgan Stanley: Reiterates “Overweight” rating with a $450 target (+25% upside).

- BofA Securities: Upgrades to “Buy,” citing “underappreciated energy storage growth” (Solar + Powerwall deployments rose 58% YoY in Q4).

- Bear Case: UBS warns of “valuation disconnect,” noting TSLA trades at 60x forward earnings vs. industry average of 22x.

5. Technical Analysis: Bullish Signals Emerge

- Resistance Level: $370 (February 2025 high).

- Support: $350 (50-day moving average).

- RSI: 62 (neutral momentum).

Chart Pattern: A breakout above $370 could target the $400–$420 range, says TradingView analysis.

6. Risks to Monitor

- Regulatory Scrutiny: NHTSA’s ongoing probe into FSD software glitches.

- Macro Headwinds: Rising lithium prices (+30% in 2025) and potential Fed rate hikes.

- Competition: BYD’s $25,000 EV launch in Europe could pressure Tesla’s market share.

7. Long-Term Outlook: Energy and Autonomy in Focus

Tesla’s Q4 earnings call emphasized two pillars:

- Energy Storage: 58% YoY growth in Powerwall deployments, targeting $20 billion revenue by 2030.

- Robotaxis: Musk confirmed a 2026 rollout for the “Tesla Network,” a ride-hailing service powered by FSD.

Why Tesla Remains a High-Volatility, High-Reward Play

Today’s rally underscores Tesla’s dual identity: an auto manufacturer and a tech disruptor. While risks like valuation and competition persist, catalysts in AI, energy, and regulatory wins make TSLA a cornerstone of growth portfolios.