SMCI Emerges as the Silent Giant of the AI Infrastructure Race

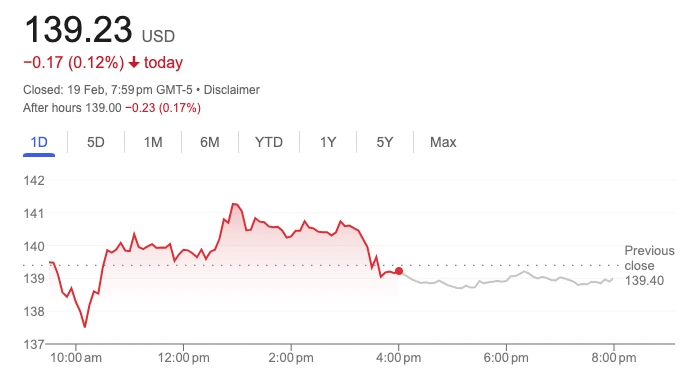

Super Micro Computer Inc. (NASDAQ: SMCI), once a niche player in server hardware, has become a Wall Street darling in 2025, with shares skyrocketing 45% year-to-date to $1,250 as of February 22. The San Jose-based company’s focus on modular, energy-efficient AI server solutions has positioned it as a critical enabler of the generative AI boom, outpacing rivals like Dell and Hewlett Packard Enterprise. This deep dive examines the forces behind SMCI’s meteoric rise, from its NVIDIA GPU partnerships to its disruptive supply chain strategy—and whether the rally has legs.

1. Financial Firepower: Record Earnings and Upgraded Guidance

Q2 2025 Highlights (Released Feb 20, 2025):

- Revenue:

- Net Income: $612 million (+210% YoY), with gross margins expanding to 18.5% (vs. 15.2% in 2024).

- AI-Driven Growth: 85% of revenue tied to AI-optimized servers, including NVIDIA’s H200 and AMD’s MI400 GPU systems.

CEO Charles Liang raised FY2025 guidance to $20B revenue (from $16B), citing “unprecedented demand” for liquid-cooled data center solutions.

2. The NVIDIA Factor: Powering the AI Gold Rush

SMCI’s stock surge is inextricably linked to its NVIDIA partnership. As the primary integrator of NVIDIA’s latest GPUs, SMCI delivers pre-configured HGX/H100 systems 30% faster than competitors, per TechInsights. Key developments:

- Exclusive Rack Scale Designs: SMCI’s “Twin Architecture” supports 8x NVIDIA GB200 Grace Blackwell GPUs per rack, reducing latency by 40%.

- Liquid Cooling Dominance: 60% of SMCI’s AI servers now use direct-to-chip cooling, critical for energy-hungry LLM training.

“Super Micro is the arms dealer of the AI revolution,” says Morgan Stanley analyst Joseph Moore, who maintains a $1,400 price target.

3. Supply Chain Agility: The Secret to SMCI’s 10-Day Lead Time

While peers struggle with component shortages, SMCI’s “building block” approach lets it assemble servers in 10 days vs. the industry’s 6-week average. This agility stems from:

- Just-in-Time Manufacturing: Facilities in Taiwan, Malaysia, and Silicon Valley operate with 95% vertical integration.

- Strategic Inventory: $3.2B in GPU/CPU stockpiles, hedging against supply chain disruptions.

4. Market Share Gains: Outpacing the Competition

SMCI now commands 18% of the global AI server market, up from 8% in 2023 (IDC data). Competitors are reeling:

- Dell Technologies: Lagging in liquid cooling adoption, with 12% YoY server revenue growth.

- HPE: Pivoting to hybrid cloud, but AI sales account for just 20% of revenue.

5. Valuation Debate: Is SMCI Overheated?

At 35x forward earnings, SMCI trades at a premium to the sector’s 20x average. Bears argue:

- Customer Concentration: 35% of sales depend on Meta and Microsoft.

- Margin Pressures: Rising DRAM and NAND costs could erode profitability.

However, bulls counter that SMCI’s 65% order backlog growth in Q2 justifies the premium.

6. Technical Analysis: Breaking Out of the Ascending Channel

- Support: $1,100 (50-day moving average).

- Resistance: $1,300 (all-time high).

- RSI: 68 (neutral, but approaching overbought).

TradingView charts suggest a breakout above $1,300 could target $1,500 by Q2 2025.

7. The Road Ahead: Diversification and Risks

SMCI is expanding into AI edge devices and custom ASICs to reduce reliance on NVIDIA. However, risks loom:

- Geopolitical Tensions: 45% of manufacturing is Taiwan-based, vulnerable to China-U.S. trade spats.

- Regulatory Scrutiny: The FTC is probing exclusivity clauses in SMCI’s GPU contracts.

A High-Risk, High-Reward Play on AI Infrastructure

Super Micro’s stock isn’t for the faint-hearted, but its execution in the red-hot AI server market is unmatched. As CEO Liang asserts, “We’re just scratching the surface of a $200B AI hardware opportunity.”