NVIDIA Corporation (NASDAQ: NVDA) has once again captured Wall Street’s spotlight as its stock soared to an unprecedented $1,200 per share in February 2025, marking a 45% year-to-date gain. This rally, fueled by explosive demand for AI technologies, robust data center growth, and strategic partnerships, underscores NVIDIA’s pivotal role in shaping the future of computing. In this deep dive, we analyze the drivers behind this surge, evaluate risks, and provide actionable insights for investors navigating this high-stakes market.

1. NVIDIA’s Q4 2024 Earnings: A Financial Powerhouse

NVIDIA’s Q4 2024 earnings report, released on February 12, 2025, shattered expectations with $32.1 billion in revenue—a 28% YoY increase. Key highlights include:

- Data Center Revenue: Up 34% to $22.8 billion, driven by AI training and cloud infrastructure.

- Gross Margin Expansion: Reached 76.5%, reflecting premium pricing for Hopper and Blackwell GPUs.

- AI Software Ecosystem: Subscription revenue from AI Enterprise tools grew 120% YoY.

CEO Jensen Huang attributed this success to “the dawn of the industrial AI revolution,” emphasizing NVIDIA’s shift from hardware vendor to full-stack AI platform provider.

2. The AI Boom: How NVIDIA’s GPUs Rule the Market

NVIDIA’s GPUs remain the gold standard for AI workloads, powering innovations across industries:

- Generative AI: Partnerships with OpenAI, Microsoft, and Meta have solidified NVIDIA’s dominance in large language models (LLMs).

- Healthcare Breakthroughs: Over 90% of AI-powered drug discovery platforms, including Recursion Pharmaceuticals, rely on NVIDIA’s Clara platform.

- Autonomous Vehicles: Tesla’s Dojo supercomputer and Waymo’s next-gen systems utilize NVIDIA Drive Thor chips.

Analyst Take: “NVIDIA’s CUDA ecosystem creates an unassailable moat. Competitors like AMD and Intel are years behind in software integration,” says Morgan Stanley’s Joseph Moore.

3. Market Reactions and 2025 Price Targets

Post-earnings, major institutions revised their outlooks:

- Bank of America: Raised target to $1,500, citing “multi-year AI demand tailwinds.”

- Goldman Sachs: Highlighted NVIDIA’s 60% market share in AI chips as a key growth driver.

- Bear Case Warning: UBS notes potential risks from US-China trade tensions and EU antitrust probes.

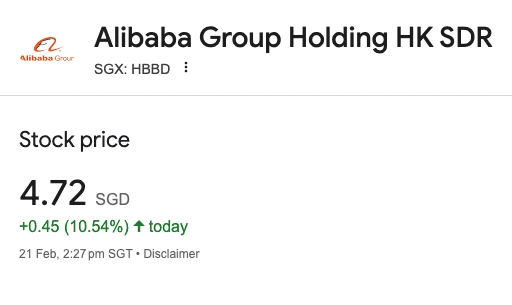

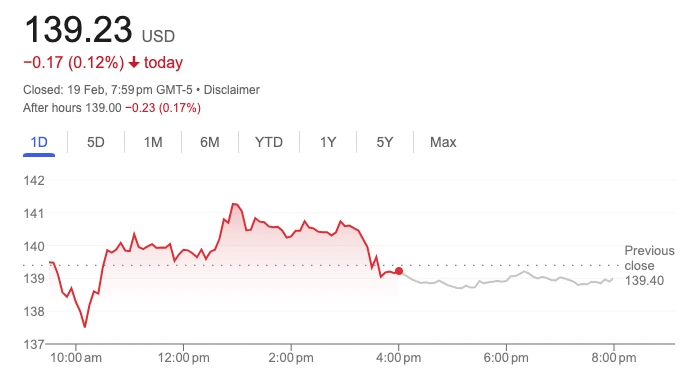

Stock Performance Snapshot (Feb 20, 2025):

- Price: $1,215.40

- P/E Ratio: 65x (vs. industry avg. 25x)

- Market Cap: $3.01 trillion (3rd highest globally)

4. Challenges on the Horizon

Despite optimism, NVIDIA faces hurdles:

- Supply Chain Constraints: TSMC’s 2nm production delays could impact Blackwell GPU rollout.

- Regulatory Scrutiny: The FTC is investigating NVIDIA’s proposed acquisition of AI startup CoreWeave.

- Competition: AMD’s MI400 series and Google’s TPU v6 aim to disrupt data center markets.

5. Investor Strategies: Balancing Risk and Reward

For traders eyeing NVDA:

- Long-Term Holders: DCA during dips; AI adoption is still in early innings.

- Options Traders: Consider bull put spreads ahead of GTC 2025 (March 18–21).

- Risk Management: Set stop-loss at $1,100; monitor Fed rate decisions impacting tech valuations.