A Paradigm Shift for the BOJ?

The Japanese yen surged to a one-month high against the U.S. dollar this week, fueled by mounting speculation that the Bank of Japan (BOJ) could end its decade-long ultra-loose monetary policy as early as April 2025. Markets are pricing in a potential rate hike after Japan’s Q4 2024 GDP growth outperformed expectations and inflation stubbornly hovered above the BOJ’s 2% target. This article unpacks the drivers behind this seismic shift, its implications for global investors, and why traders are scrambling to reposition ahead of the BOJ’s April meeting.

1. Yen Surges to One-Month High: Markets Bet on Policy Normalization

The USD/JPY pair plummeted to 155.08 on January 21, 2025, nearing its lowest level since December 2024, as hedge funds and institutional investors increased short positions on the dollar-yen. Key catalysts include:

- BOJ Governor Kazuo Ueda’s hawkish signals: In a January 18 speech, Ueda acknowledged that “the likelihood of sustainably achieving 2% inflation is gradually rising,” a stark contrast to the BOJ’s long-held deflation rhetoric.

- Stronger-than-expected GDP: Japan’s Q4 2024 GDP grew by 0.6% quarter-on-quarter (vs. 0.3% forecast), driven by robust consumer spending and capital expenditure.

- Global central bank alignment: With the Federal Reserve and European Central Bank maintaining restrictive rates, pressure mounts on the BOJ to curb yen depreciation and imported inflation.

2. Inflation Pressures Mount: Is Japan Finally Escaping Deflation?

Japan’s core inflation rate has remained above 3% for 18 consecutive months, with January 2025 data hitting 3.2%—well above the BOJ’s target. Structural drivers include:

- Wage-growth momentum: Major corporations like Toyota and Hitachi agreed to 4.5% average wage hikes in 2025, the largest in 30 years.

- Weak yen fallout: The yen’s 20% depreciation against the dollar since 2022 has inflated energy and food import costs, squeezing households.

- Government pressure: Prime Minister Fumio Kishida’s administration openly supports policy normalization to stabilize living costs ahead of 2025 elections.

3. Global Context: Trump’s Tariff Threats and Fed Policy

The BOJ’s dilemma is compounded by external volatility:

- U.S. Treasury yields: 10-year yields spiked to 4.5% in January 2025, widening the U.S.-Japan rate gap and forcing BOJ intervention to cap JGB yields.

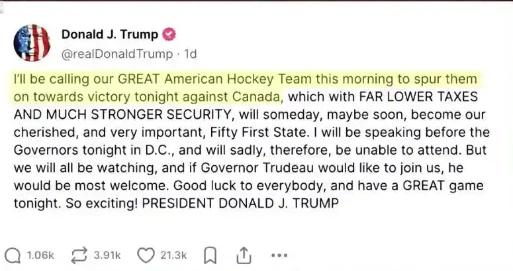

- Trump’s trade agenda: Markets remain wary of former President Trump’s proposed 10% tariffs on Chinese goods and 25% levies on Canada/Mexico, which could disrupt supply chains and amplify yen safe-haven demand.

- FOMC minutes: The Fed’s hawkish tilt (“higher for longer”) contrasts with BOJ dovishness, but a policy shift in Tokyo could recalibrate cross-border capital flows.

4. Market Reactions: Equities, Bonds, and the “Short Yen” Unwind

- Nikkei volatility: Japan’s benchmark index traded flat YTD after a 20% rally in 2024. BofA notes that BOJ hike risks are “partially priced in,” but tech and export-heavy sectors face headwinds if the yen strengthens further.

- JGB sell-off: 10-year Japanese government bond yields rose to 1.2% in January, the highest since 2014, as traders anticipate reduced BOJ purchases.

- Carry trade reversal: Hedge funds unwinding yen-short positions (a $60B trade) triggered sharp FX swings, with Nomura warning of “asymmetric risks” in Q1 2025.

5. Expert Insights: Timing and Magnitude of BOJ Action

- Morgan Stanley: Predicts a 15-bps hike in April, lifting the policy rate from -0.1% to 0.05%, followed by a gradual tightening cycle.

- BlackRock: Argues the BOJ will prioritize yield curve control (YCC) tweaks over abrupt rate hikes to avoid destabilizing Japan’s debt-laden economy (public debt: 260% of GDP).

- Domestic backlash: SMBC Nikko analysts warn that premature tightening could derail Japan’s fragile recovery, citing 2024’s “technical recession” as a cautionary tale.

6. Strategic Takeaways for Investors

- FX strategies: Long yen (JPY) vs. AUD or EUR as BOJ-Fed divergence narrows.

- Equity sectors to watch: Avoid exporters (e.g., automakers) and favor banks (e.g., Mitsubishi UFJ) benefiting from higher rates.

- Fixed income: Short-duration JGBs remain vulnerable; consider inflation-linked bonds.

A Watershed Moment for Japan’s Economy

The BOJ’s potential rate hike marks a historic pivot from its decades-long battle against deflation. While risks of policy missteps loom—especially given Japan’s precarious debt dynamics—the move aligns with global central banks’ post-pandemic normalization playbook. Investors should brace for heightened volatility in JPY assets, with April’s meeting poised to redefine Asia’s financial landscape.