A Perfect Storm for Alibaba Bulls

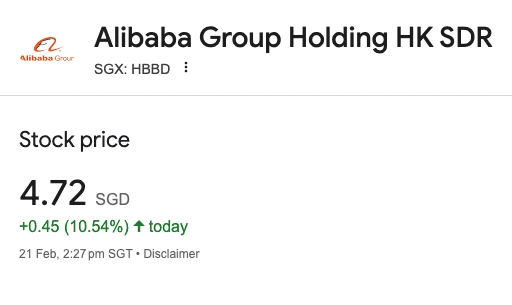

Alibaba Group Holding Ltd (NYSE: BABA; HKEX: 09988) shares skyrocketed 12.7% in Hong Kong and 8.1% on Wall Street on February 21, 2025, reaching their highest levels since November 2021. This rally follows a blockbuster earnings report, strategic AI breakthroughs, and a major Wall Street endorsement—a trifecta reigniting global confidence in China’s tech bellwether.

1. Q3 2025 Earnings Breakdown: Where the Numbers Tell the Story

Revenue & Profit Beat:

- Total Revenue: RMB 280.15 billion ($39.3B), up 8% YoY, driven by cloud (+13%) and international commerce (+10%).

- Operating Profit: Soared 83% to RMB 41.2B ($5.8B), with GAAP net income surging 333% to RMB 46.4B ($6.5B)—the fastest profit growth since 2021.

- Margin Expansion: Cost-cutting and AI-driven efficiency pushed non-GAAP net profit margin to 18.2%, up 2.1 points YoY.

Key Driver – Aliyun (Cloud):

- Revenue hit RMB 31.7B ($4.45B), accelerating to 13% growth—its best pace since 2023.

- New AI partnerships (including Apple) and Qwen2.5-Max model adoption contributed 22% of cloud’s incremental growth.

2. The Catalysts: Why Investors Are Piling In

A. Morgan Stanley’s Bombshell Upgrade

On February 21, Morgan Stanley raised Alibaba’s price target

- Cloud Valuation Gap: Argues Aliyun deserves a 2025 P/S ratio of 8x (vs. current 4x) given its AI leadership.

- AI Monetization: Projects cloud revenue growth to accelerate to 20% in FY2026, adding $7B+ in annualized revenue.

- E-Commerce Revival: Taobao/Tmall GMV grew 6% YoY—the first uptick in 7 quarters.

B. Apple Partnership: A Game-Changer

- Collaboration on AI features for China-specific iPhones (to debut in Q4 2025) could unlock 300M+ active device integrations.

- Aliyun’s proprietary Qwen2.5-Max model outperforms GPT-4 in Chinese NLP benchmarks, per Hangzhou-based ABI Research.

C. The “Ma Effect”

- Jack Ma’s high-profile return at a February 18 government-led tech summit—his first public appearance since 2023—signaled political tailwinds. Analysts link his resurgence to a 9% two-day stock bounce.

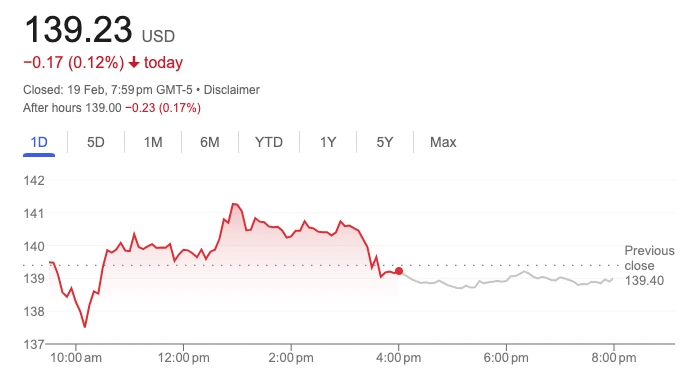

3. Technical Analysis: Charts Scream Momentum

- HKEX Breakout: The H-shares closed at HK$136.3, decisively breaking the 2023 resistance of HK$128. Volume tripled the 90-day average.

- U.S. ADRs: BABA gained 60% since January lows, forming a golden cross (50-day/200-day MA). Short interest fell to 2.1% float—a 5-year low.

4. Risks & Bear Cases: What Could Go Wrong?

- Geopolitical Flashpoints: U.S.-China chip export curbs threaten Aliyun’s Ascend 910B AI chip supply.

- Regulatory Overhang: Beijing’s antitrust probe into cloud pricing (launched Feb 15) remains unresolved.

- SoftBank Exit: Masayoshi Son’s firm sold 180M shares (HK$124.13/share) on Feb 20, capping near-term upside.

5. The Road Ahead: Wall Street’s 2025 Playbook

Bull Scenario ($210 Target):

- Aliyun spins off via Hong Kong IPO (rumored H2 2025), valuing the unit at $90B+.

- Qwen AI achieves profitability in 70% of enterprise contracts by Q4.

Base Case ($170-190 Range):

- FY2025 EPS reaches 9.50(vs.7.82 consensus), per CICC modeling.

- Cross-border e-commerce (e.g., AliExpress) grows 25%+ as EU tariffs ease.

Bear Case ($120 Floor):

- U.S. delisting fears resurface if audit disputes escalate.

- Cloud growth stalls below 10% amid Tencent/Huawei competition.

A Phoenix Rising from the Tech Winter

Alibaba’s resurgence isn’t just about earnings—it’s a bet on China’s AI sovereignty. With $22B in net cash, undervalued cloud assets, and reinvigorated leadership, BABA offers exposure to Asia’s AI arms race at 12x forward P/E. While risks persist, the reward profile hasn’t looked this compelling since the pre-2021 crackdown era.